Integrate your loyalty program into our white-label card to discover enhanced client convenience and leverage data insights for steady business advancement

Get branded (plastic, full-metal, etc.) private and business VISA debit cards

Offer contactless payments and cash withdrawals worldwide

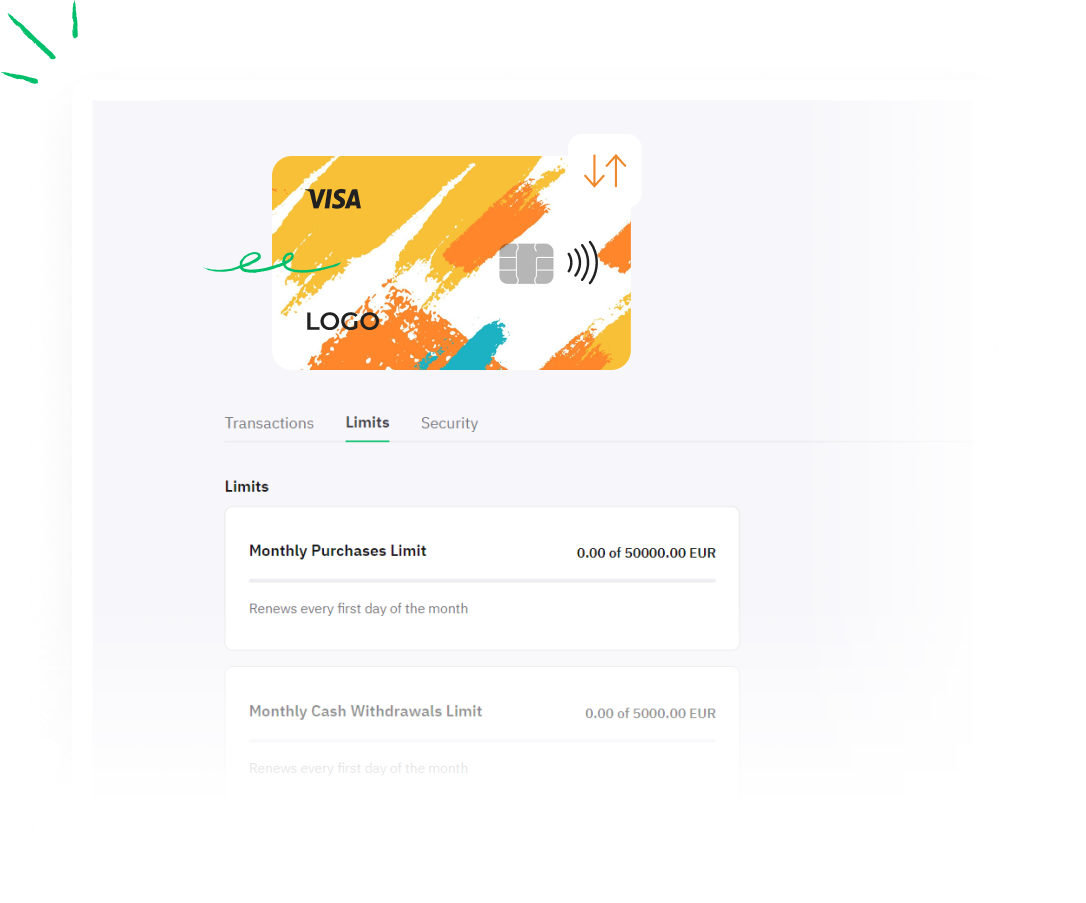

Integrate cards into your app and give users the power to manage their cards in a few taps

Receive and distribute as many white-label cards as you need – one IBAN account has no card limits

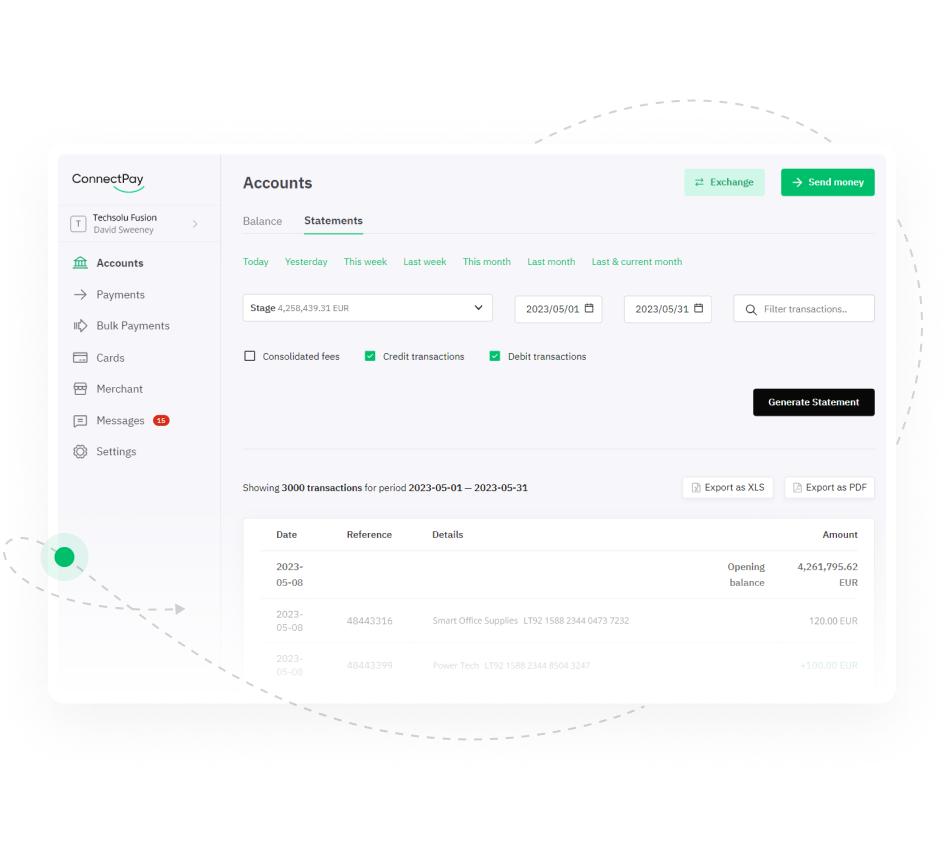

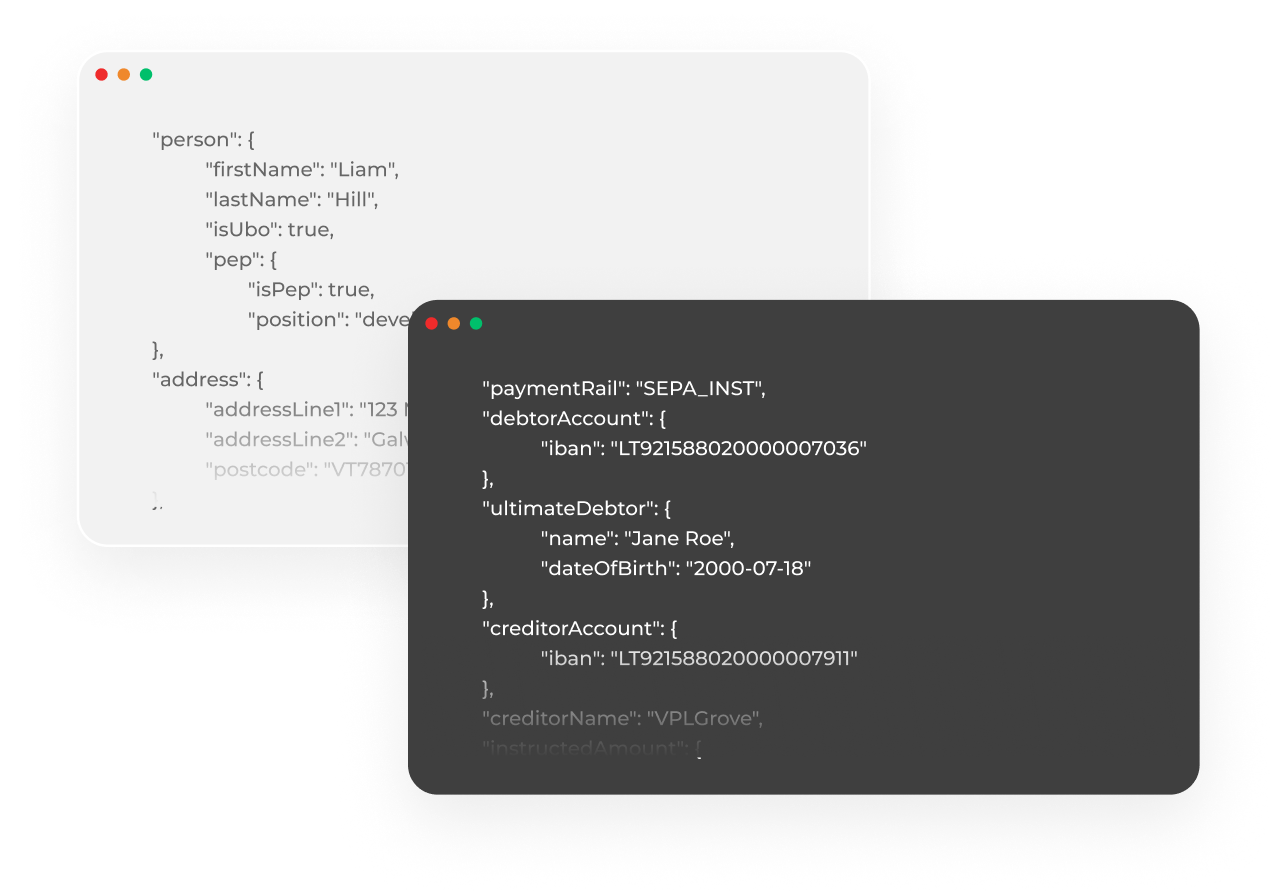

Conveniently access and manage your private label cards within your interface via APIs.

Merge your loyalty program with the white-label VISA card to enhance your clients’ experience.

A white-label card works just like any other VISA card. Card holders can withdraw cash from any ATM across the EEA, without any hidden charges.

Our branded debit cards are easy to integrate into your existing financial infrastructure.

Promote your brand and turn loyal customers into brand ambassadors. With branded debit cards, your business gets promotion with every transaction.

When it comes to convenience and flexibility, VISA debit is difficult to beat.

After it’s been activated, all branded debit cards can be used the world over.

With VISA’s proven Chip & Pin technology, card holders are guaranteed enhanced transaction protection against fraud and financial loss.

VISA provides real-time payment information and updates that can be used for multiple purposes.

Card users enjoy full protection for their payments and purchases.

Our data ecosystem helps you protect your business from fraud, provide customer-friendly authentication, and develop your business based on data-driven insights.

Choose embedded finance with built-in compliance solution modules based on your business needs

Yearly Payment Turnover

Processed transactions in 2023

Client funds held by ConnectPay