We simplify the development process by delivering an EEA-licensed and ready-to-use embedded finance platform into your service offering with the least possible investment and without having to go through the lengthy process of getting a license.

Choose embedded finance with built-in compliance solution modules based on your business needs

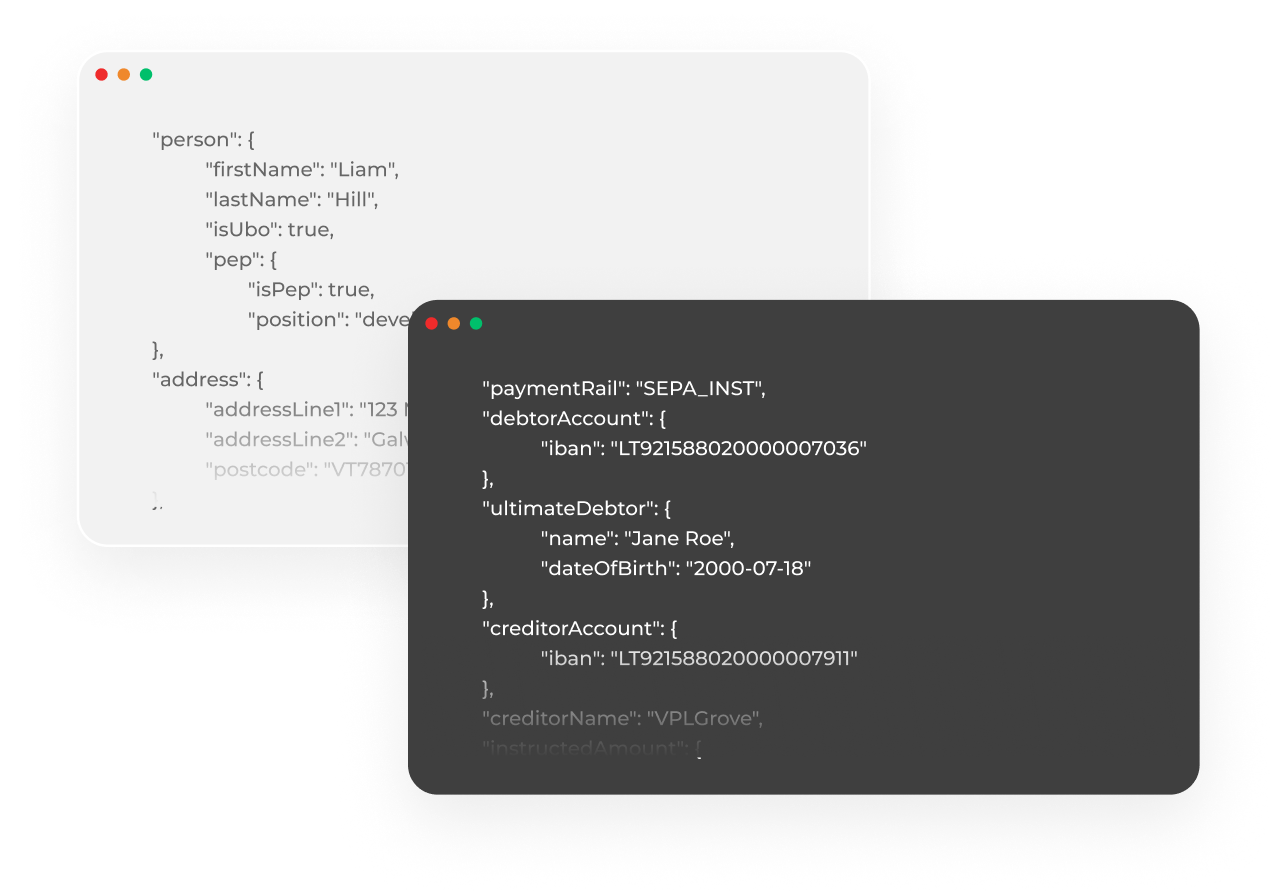

Let your customers from the European Economic Area open IBAN accounts

From the usual business and personal cards to white–labeled ones with extra functionalities. Just tell us what kind of cards you need.

Yearly payment turnover

Processed transactions in 2023

Clients fund held by ConnectPay